What Harvard, MIT, and other top-ranked institutions might be missing in the global enrollment game.

By Lindsey Kundel, Editor in Chief

When I first started working in international education, I noticed a pattern: Chinese students with perfect grades and test scores often aimed for the same handful of U.S. institutions—Harvard, Stanford, MIT, maybe Columbia or Yale. Prestige felt like the driving force. But over the past decade—and especially since the pandemic—that pattern has shifted. While elite U.S. universities still dominate global rankings, their actual enrollment numbers tell a more complicated story. Many of the country’s most prestigious institutions now enroll fewer Chinese students than regional public universities in the Midwest or the University of California system.

And those numbers haven’t rebounded the way others have since COVID.

So what’s going on? Why are some of the most recognizable names in American higher ed enrolling fewer Chinese students in 2025—and what does that tell us about prestige, price, and perceived risk in the international education market?

Despite their global reputations, many of these top-ranked schools now enroll fewer Chinese students than public universities like UIUC, Ohio State, or UC Irvine. While other international markets have rebounded post-COVID, Chinese enrollment at elite U.S. institutions remains low—and in some cases, is still shrinking. This isn’t just a statistical blip. It’s a signal that something deeper is shifting in how Chinese families assess value, risk, and return on investment.

Note: Unless otherwise stated, all enrollment data refers to newly enrolled F-1 Chinese students in the 2023–2024 academic year, as reported in SEVIS.

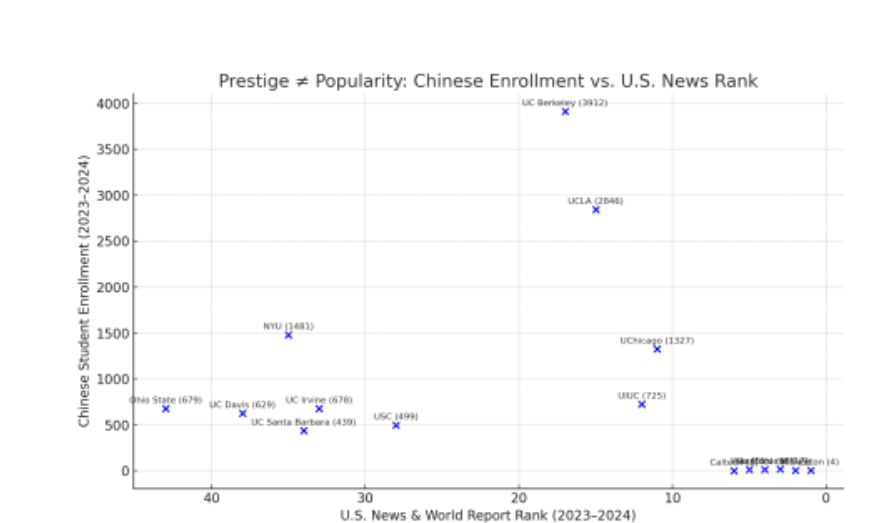

The Data: Prestige ≠ Popularity

SEVIS enrollment data for the 2023–2024 academic year reveals a striking trend: universities that rank highest on U.S. News lists don’t necessarily enroll the most Chinese students. In fact, the most prestigious universities often enroll far fewer Chinese students than their public counterparts.

| University | Newly Enrolled Chinese Students (2023–24) |

| New York University (NYU) | 1,481 |

| University of Illinois Urbana–Champaign (UIUC) | 725 |

| Ohio State University | 679 |

| UC Irvine | 678 |

| UC Davis | 629 |

| UC Santa Barbara | 439 |

| University of Wisconsin–Madison | 423 |

| University of Washington – Seattle | 420 |

| Northeastern University | 394 |

| University of Minnesota – Twin Cities | 368 |

| Boston University | 348 |

| University of Michigan – Ann Arbor | 336 |

| University of California – Berkeley | 255 |

| University of Southern California (USC) | 253 |

| University of Pittsburgh – Pittsburgh Campus | 251 |

Data Source: SEVIS (U.S. Department of Homeland Security, 2024).

These aren’t typos. Several Ivy-caliber schools enroll fewer than 20 new Chinese students per year. Meanwhile, large public universities are enrolling hundreds—or in some cases, over a thousand.

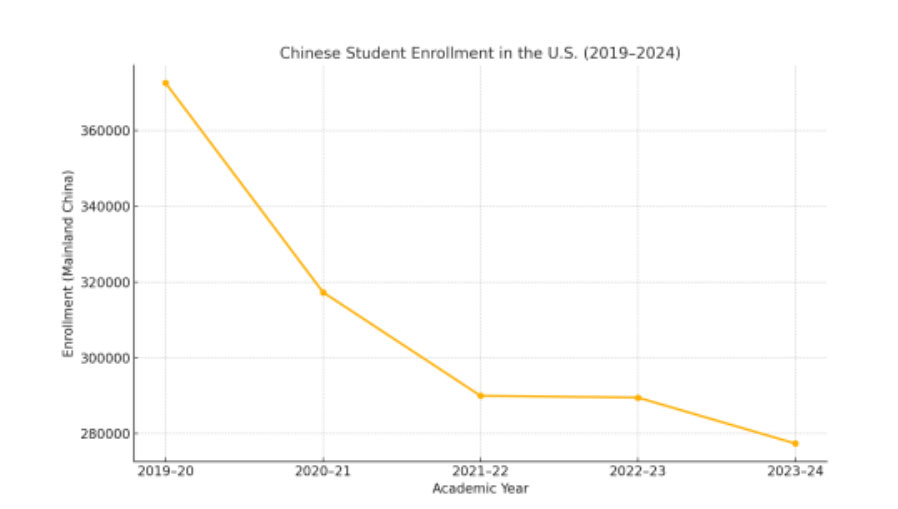

A National Trend: Enrollment Is Strategic, Not Declining

According to SEVIS, 329,500 Chinese students held active F-1 or M-1 visas in 2024, representing a 0.25% decline from the previous year. Open Doors data reports approximately 277,400 mainland Chinese students enrolled in U.S. institutions in 2023–2024—a modest 4% year-over-year drop.

Meanwhile, India surged ahead, with over 331,000 students now studying in the U.S., overtaking China for the first time in over a decade.

| Metric | 2022–23 | 2023–24 | Change |

| Total Chinese enrollment (Open Doors) | ~289,500 | ~277,400 | -4.2% |

| SEVIS active visa records | ~330,300 | 329,500 | -0.25% |

| Indian student enrollment (Open Doors) | ~268,900 | ~331,000 | +23% |

While these drops aren’t dramatic, they represent a plateauing of Chinese enrollment—especially at the undergraduate level. The story here isn’t about disappearance. It’s concentration.

Sources: Open Doors (IIE, 2024); SEVIS via DHS Study in the States; WES/WENR (2024).

Underrepresented Top-Ranked U.S. Schools by Chinese Enrollment (2023–24):

| U.S. News Rank | University | New Chinese Student Count | Approximate Student Body Population (Graduate + Undergraduate) |

| 1 | Princeton | 4 | 8,842 |

| 2 | MIT | 5 | 11,920 |

| 3 | Harvard | 17 | 30,386 (20,807 full time) |

| 4 | Stanford | 15 | 17,529 |

| 5 | Yale | 13 | 14,854 |

| 6 | Caltech | 3 | 2,463 |

| 10 | UPenn | 23 | 23,55 |

The Context: A New Generation of Chinese Decision-Makers

Today’s Chinese families are weighing multiple factors beyond rankings:

- Will my child be safe and supported?

- What is the post-grad ROI?

- Will they thrive in a STEM or business pathway?

- Is there an existing community or diaspora network?

“Parents are thinking less about prestige and more about where their children will be supported and secure.”

— The Wall Street Journal, March 2024

The decision calculus has changed. Trust, outcomes, and comfort matter as much as reputation.

The Visa & Trust Factor

Since 2020, STEM students in particular have faced increased visa scrutiny. According to reporting from the South China Morning Post and China Daily, some students have experienced revocations or delays due to perceived national security concerns.

Elite institutions, already high-profile, may appear riskier unless they make their support systems clear. The result? Some families are choosing large public universities with visible support structures and visa experience.

Political Headwinds: The Trump–Harvard Effect

In 2024, former President Donald Trump returned to the political stage with sharp critiques of elite institutions. At a February rally, he called for limits on student visas and investigations into foreign influence at universities like Harvard (CNN, 2024).

“We’re going to put America’s students first,” Trump declared at a February 2024 rally, urging Congress to limit student visas and investigate foreign influence on elite campuses.

(CNN, Feb 2024)

Even if policy doesn’t immediately change, perception does—and that affects family decision-making abroad.

Trust, Equity, and the Post-Affirmative Action Fallout

These questions of inclusion and trust were further complicated by the 2023 Supreme Court decision striking down race-conscious admissions at most U.S. universities.

For some Chinese families, the ruling was welcomed as a step toward meritocracy—especially after years of concern about potential race-based caps on Asian applicants.

But for others, it unearthed deeper doubts. Internal admissions data released during the Students for Fair Admissions v. Harvard case revealed just how much weight was placed on legacy status, donor affiliation, and “personal qualities”—criteria many international families feel unequipped to influence.

Who’s Winning—and Why

The U.S. schools with the strongest Chinese enrollment aren’t always the highest-ranked. But they tend to have:

- Large STEM programs

- Lower perceived political risk

- Deep diaspora networks

- Transparent cost and visa support

- Longstanding presence in Chinese high schools and parent networks

University Newly Enrolled Chinese Students (2023–24)

| University | Newly Enrolled Chinese Students (2023–24) |

| New York University | 1,481 |

| UIUC | 725 |

| Ohio State | 679 |

| UC Irvine | 678 |

| UC Davis | 629 |

| UC Santa Barbara | 439 |

| Wisconsin–Madison | 423 |

| Washington–Seattle | 420 |

The California Advantage: Community + Proximity

There’s also a geographic logic to these trends.

California is home to the largest Chinese American population in the U.S., with an estimated 1.5–1.8 million people identifying as Chinese alone or in combination, including nearly 800,000 mainland-born immigrants. That’s more than one-third of the U.S. Chinese population (Pew Research, 2024).

For Chinese families, California offers:

- Closer proximity to China

- Deep Mandarin-speaking networks

- A track record of post-grad outcomes

- Reputational safety and cultural familiarity

This makes schools like Berkeley, UCLA, UC Irvine, and UC Davis first-choice destinations, not fallback options.

By contrast, Ivy-caliber schools in the Northeast enrolled only a handful of Chinese students in 2023–24:

- Harvard: 17

- MIT: 5

- Stanford: 15

- Yale: 13

- Princeton: 4

The gap isn’t just about branding—it’s about ecosystem fit.

A Niche Worth Watching: Arts-Focused Institutions and Chinese Enrollment

While many Chinese families are becoming more cost-conscious, there’s one sector where high tuition appears to be less of a deterrent: specialized arts colleges.

According to SEVIS data, schools like the School of Visual Arts, Berkeley College of Music, and Rhode Island School of Design continue to draw strong numbers of new Chinese enrollments each year—despite net tuition often exceeding $50,000 USD. What’s more, at many of these institutions, Chinese students make up a notably large percentage of the incoming international class, suggesting a kind of micro-saturation within their specific niches.

| University | Average Verified Net Tuition (USD) | Newly Enrolled Chinese Students (2023–24) |

| School of Visual Arts | $ 44,856 | 307 |

| Berklee College of Music | $ 45,302 | 229 |

| Art Center College of Design | $ 47,034 | 198 |

| Savannah College of Art and Design | $ 32,829 | 120 |

| School of the Art Institute of Chicago | $ 44,333 | 99 |

| Pratt Institute-Main | $ 55,493 | 73 |

| Musicians Institute | $ 27,531 | 71 |

| Academy of Art University | $ 33,547 | 59 |

| Rhode Island School of Design | $ 59,718 | 54 |

| California College of the Arts | $ 47,633 | 51 |

These schools often offer:

- Globally respected reputations in their fields (music, visual art, animation, industrial design)

- Looser GPA/test score thresholds than elite academic institutions

- Portfolios or performance-based admissions processes that may appeal to creative students who thrive outside standardized academics

In other words, they represent a prestige play—but in a non-traditional lane.

A counselor at an international school in Shanghai once told me, “Families are willing to spend for RISD or Berkeley the same way they’d spend for NYU or USC. It’s just a different type of prestige.”

For students pursuing music, animation, or fine arts, these institutions remain desirable destinations—even if the ROI isn’t always visible in salary data. They offer network value, credibility, and international legitimacy for careers that may not follow linear financial trajectories.

Did Strategic International Recruitment Help Certain Schools Rise?

A decade ago, Duke, Northwestern, and the University of Chicago weren’t regular fixtures in the U.S. News Top 10. But now? All three sit near the summit—despite being smaller and (at times) less resourced than their Ivy League peers.

One possible factor: their early and aggressive efforts to recruit Chinese students. Chinese applicants often bring:

- Top test scores and GPAs (boosting selectivity metrics)

- Full-pay tuition (improving financial resources/per-student spending)

- Strong research interest, feeding graduate school and pipeline programs

By contrast, schools like Dartmouth saw rankings decline over the same period—despite similar prestige and outcomes. Their lack of visibility in China (and less favorable climate) may have made them less appealing and less competitive in a metric-driven era.

While correlation ≠ causation, the data suggests that international enrollment may have been an under-appreciated lever in the rise of certain private U.S. universities.

Want to know more? A forthcoming analysis explores these connections in detail—tracking U.S. News rankings alongside Chinese enrollment trends and global ranking shifts for seven universities.

Should Elite Schools Be Concerned?

If elite universities are intentionally shifting focus—toward domestic yield, other global markets, or smaller incoming classes—this trend may seem manageable. But if they still aspire to be truly global institutions, then yes—this trend matters.

Chinese students have historically been high-achieving, full-paying, and brand loyal. If they’re opting out not because of rejection but because of disillusionment, something fundamental is being lost.

3 Ways to Rebuild Trust

Elite institutions won’t reverse this trend overnight. But here’s where they can start:

- Humanize the Brand

Showcase Chinese students, alumni, faculty, and success stories. Go beyond selectivity—demonstrate belonging. - Demystify the Process

Offer multilingual, transparent resources about tuition, visa support, and career pathways. Remove ambiguity. - Be Present in the Right Places

Participate in Chinese webinars, WeChat Q&As, and counselor networks—even if yield is currently low. Visibility builds trust over time.

Final Takeaway

Chinese students still care deeply about academic rigor and ambition. But they are also more attuned than ever to value, belonging, and future security.

If elite U.S. universities want to retain their place on the global stage, they’ll need to rethink not just their selectivity—but their story.